With rapid technological advances and increased internet use in business, cybersecurity has become a major global concern, especially in digital banking and payments. Digital systems offer efficiency and convenience but expose users to fraud risks, including identity theft and unauthorized access. Traditional methods struggle to keep up with complex fraud tactics, pushing financial institutions to adopt AI-based solutions. AI enhances fraud detection by analyzing vast transaction data, identifying suspicious patterns, and automating threat detection. However, high costs and data quality issues pose challenges, especially for smaller institutions, underscoring the need for balanced, effective cybersecurity measures in the financial sector.

Current bank security systems often fall short against today’s advanced cyber threats due to outdated technologies. Traditional reactive measures respond only after a breach, making them ineffective against sophisticated or new attacks. Legacy banking systems, which lack features like real-time monitoring and multi-factor authentication, are particularly vulnerable. This reliance on outdated methods exposes banks to financial losses, reputational harm, and regulatory penalties. Banks must adopt proactive, technology-driven strategies to address these risks, leveraging AI, machine learning, and behavioral analytics. Fostering cybersecurity awareness among employees can further strengthen defenses against cyber threats.

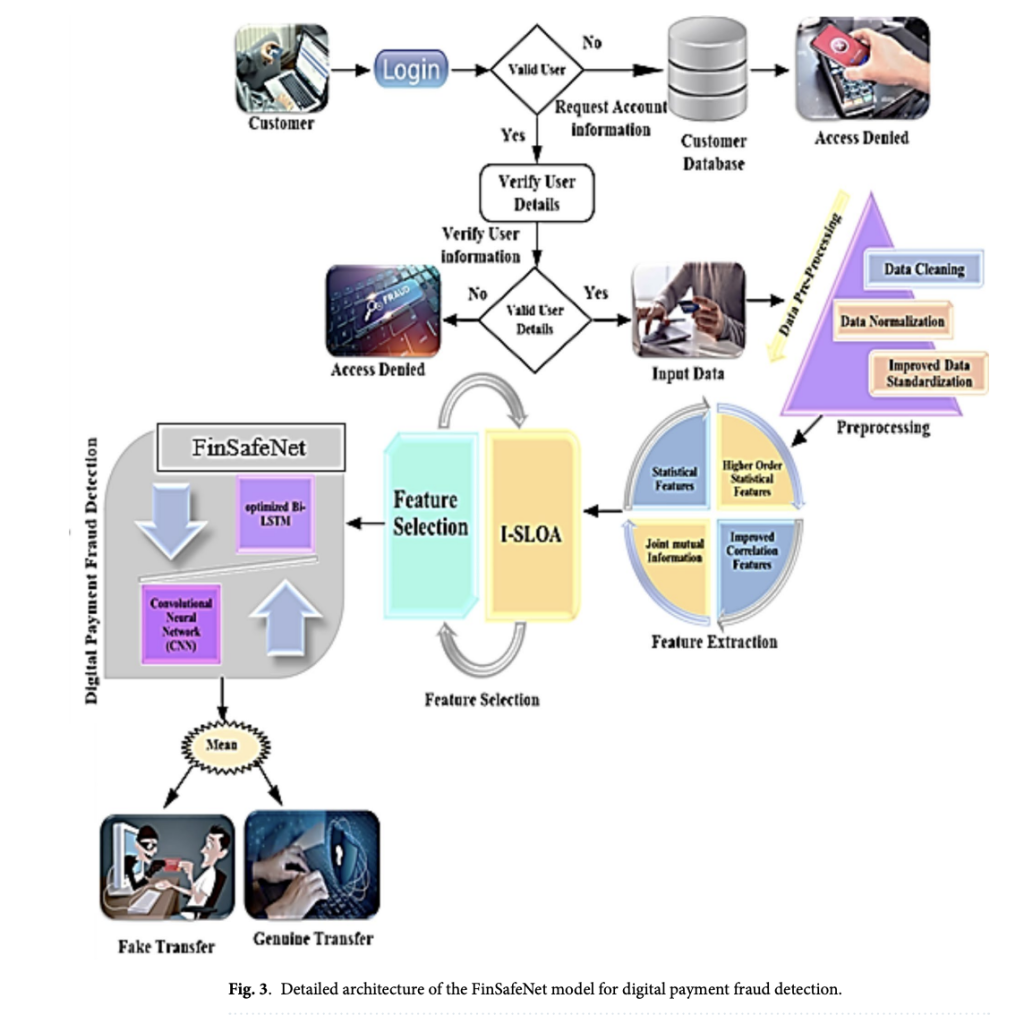

Researchers from Majmaah University, King Saud University, and the University of Wollongong developed FinSafeNet, a deep-learning model for secure digital banking. Based on a Bi-LSTM, CNN, and a dual attention mechanism, this model addresses real-time transaction security. It incorporates an Improved Snow-Lion Optimization Algorithm (I-SLOA) for efficient feature selection, blending Hierarchical Particle Swarm Optimization and Adaptive Differential Evolution. FinSafeNet also employs Multi-Kernel PCA with Nyström Approximation to reduce computational demands and enhance performance. Tested on the Paysim database, it achieved 97.8% accuracy, surpassing traditional models and improving digital banking transaction security.

The proposed cybersecurity model for digital banking utilizes deep learning, beginning with data acquisition from the PaySim and Credit Card datasets, which simulate mobile money and card transactions to study fraud. Data is cleaned and normalized, with missing values filled and superfluous columns removed. Key features are extracted using Joint Mutual Information Maximization (JMIM), which outperforms standard methods by identifying the most relevant features for fraud detection. Further, an optimized feature subset is selected through an I-SLOA, which combines adaptive differential evolution and particle swarm optimization, enhancing detection accuracy across both datasets.

The FinSafeNet model, implemented in Python, was evaluated using the Paysim and Credit Card datasets. Compared to state-of-the-art models like VGGNET, RESNET, and CNN, FinSafeNet achieved superior results across metrics like accuracy, precision, sensitivity, and specificity. It reached 97.9% accuracy on Paysim and 98.5% on Credit Card data, with low error rates (FPR and FNR). Its dual-attention mechanism, Bi-LSTM integration, and optimized feature selection made it highly effective for fraud detection. However, FinSafeNet’s adaptability depends on diverse training data and could face real-time scalability challenges.

In conclusion, the FinSafeNet model offers a major advancement in digital banking security, leveraging Bi-LSTM, CNN, and a dual-attention mechanism for accurate fraud detection with minimal processing time. Enhanced by the I-SLOA, which combines HPSO and ADE for high-quality feature selection, the model achieved 97.8% accuracy on the Paysim dataset, surpassing traditional methods. By integrating Multi-Kernel PCA (MKPCA) with Nyström Approximation, it efficiently handles large datasets without compromising performance. FinSafeNet’s success suggests its potential for real-time deployment in diverse banking environments, and future blockchain integration could further reinforce transaction security against cyber threats.

Check out the Paper. All credit for this research goes to the researchers of this project. Also, don’t forget to follow us on Twitter and join our Telegram Channel and LinkedIn Group. If you like our work, you will love our newsletter.. Don’t Forget to join our 55k+ ML SubReddit.

[Upcoming Live LinkedIn event] ‘One Platform, Multimodal Possibilities,’ where Encord CEO Eric Landau and Head of Product Engineering, Justin Sharps will talk how they are reinventing data development process to help teams build game-changing multimodal AI models, fast‘

The post FinSafeNet: Advancing Digital Banking Security with Deep Learning for Fraud Detection and Real-Time Transaction Protection appeared first on MarkTechPost.