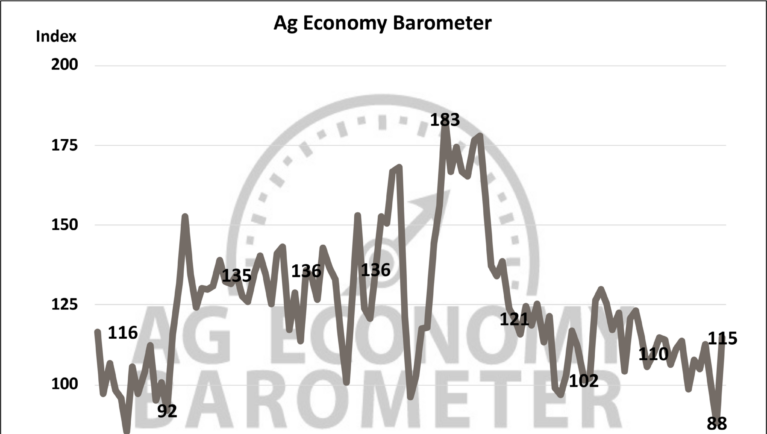

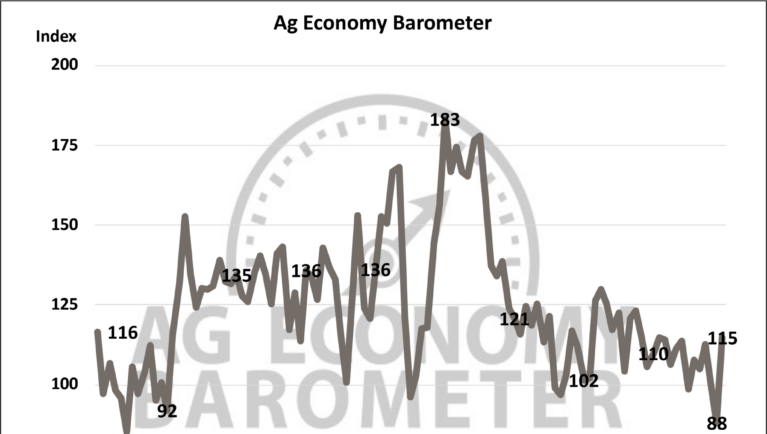

U.S. farmers’ economic confidence dropped to its lowest level in eight years in September before unexpectedly surging in October ahead of the U.S. election, according to the latest Ag Economy Barometer monthly survey of U.S. farmers by Purdue University and CME Group. The index climbed 27 points over September to close October at 115 points. The jump in confidence was largely driven by a boost in farmers’ future outlook, as shown by the Future Expectations Index, which increased 30 points to 124. The Current Conditions Index also saw an increase, rising from 76 points in September to 95 in October. However, that Index still reflects concerns among farmers that this year’s economic conditions lag behind last year and are weaker than the barometer’s 2015-16 baseline. Despite current challenges, the October survey hints that producers have some optimism that economic conditions might improve, potentially avoiding a prolonged downturn in the farm economy.

“Examining responses to the barometer’s individual questions helps us understand the producers’ shift toward a less pessimistic view of the U.S. agricultural economy,” said James Mintert, the barometer’s principal investigator and director of Purdue University’s Center for Commercial Agriculture, in a release.

In October, just over half — 53% — of U.S. producers anticipated challenging conditions in the year ahead for the U.S. agricultural economy. That’s a significant decrease from the 73% who expected challenges ahead when surveyed in September. Similarly, farmers reported less concern about the slightly longer future outlook: 33% of producers reported foreseeing tough times in the next five years, down from 48% the previous month. Additionally, fewer producers reported expecting financial strain on their farms to get worse over the next year: whereas 38% expected poorer farm financial conditions over the next 12 months in September, 23% reported the same concern in October.

“While producer sentiment improved in October, many respondents indicated they are still feeling financial strain due to the deterioration of their financial situation throughout 2024,” said Mintert. “Over half of the producers we surveyed reported that their farm’s financial condition was worse than a year ago, which underscores the ongoing challenges producers face despite their more optimistic outlook for the year ahead.”

Each monthly Ag Economy Barometer survey concludes with an open-ended question that allows respondents to share their thoughts and concerns. Not surprisingly given the U.S. election’s proximity, politics was a top-of-mind priority for many farmers in October. Many farmers voiced concerns about potential policy changes affecting their farms and the broader agricultural economy, with particular focus on regulations, environmental policies, and tax implications. When asked about their primary concerns for the coming year, rising input costs and dropping output prices were cited most frequently. This month, fewer producers expressed concerns over interest rates, with only 15% listing it as a top worry, down by nearly half from 26% in late 2023.

One of the October survey’s most surprising findings was a significant rise in the Farm Financial Performance Index, which reflects farmers’ expectations for their financial performance over the next 12 months compared to the previous year. The index rose by 22 points to 90 in October, just 2 points below last year’s level. Factors likely contributing to this improvement include high fall crop yields and a smooth harvest season across the Corn Belt and Plains states. This index’s growth also suggests increasing optimism about farmers’ financial outlook, with higher expectations for 2025 compared to 2024. Farmers appear to view 2024’s weaker income prospects as temporary, reflected in a modest rise in the Farm Capital Investment Index, which rose by 7 points over September to 42.

The Farmland Value Expectation indices for both short-term and long-term improved this month, indicating that farmers remain somewhat optimistic about the future strength of the agricultural economy, which could help uphold farmland values. The Short-Term Farmland Value Expectations Index rose to 120, up 25 points over September, while the long-term index climbed to 159, up from 147 a month previous.

This month’s survey data was collected from Oct. 14-18, 2024.

The post Farmer Optimism Tracked Upward in October Ahead of U.S. Election appeared first on Seed World.